On Tuesday, Eastern Standard Time (EST), Wall Street giant Morgan Stanley reported its Q1 2024 earnings. The bank's first-quarter results exceeded expectations, driven by a robust recovery in its investment banking business—a significant win for new CEO Ted Pick. Shares of Morgan Stanley rose by more than 3.5% before the U.S. trading session.

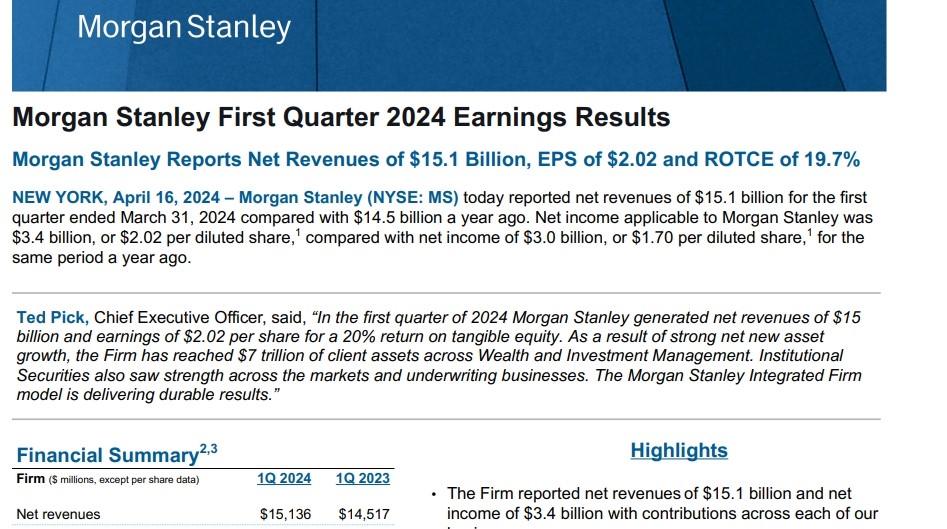

The earnings report indicated that Morgan Stanley's first-quarter revenue was $15.14 billion, surpassing market expectations of $14.46 billion. Net income for the quarter was $3.4 billion, or $2.02 per share, up from $3 billion, or $1.70 per share, in the same period a year prior.

In a statement, Ted Pick, Morgan Stanley's Chief Executive, said, "Due to strong net new asset growth, the firm has reached $7 trillion in client assets in wealth and investment management."

Pick, who assumed office in January, is now tasked with persuading investors that he can sustain the earnings growth rate set by his predecessor, reinvigorate the investment bank he leads, and accelerate the expansion of its wealth management business.

The investment bank has recovered from a more than two-year trading slump as large corporations issue near-record levels of bonds, and equity capital markets become more dynamic.

Revenue from Morgan Stanley's investment banking business increased by 16% to $1.45 billion in the first quarter compared to the same period last year. Fixed-income underwriting was a standout for the second consecutive quarter, propelled by an increase in bond issuance.

While advisory revenue fell by nearly 28% in the first quarter, equity underwriting saw a substantial surge of nearly 113% to $430 million.

Morgan Stanley's wealth management revenue was $6.9 billion in the first quarter, up from $6.6 billion a year earlier. The bank has transformed its wealth management business into a more stable revenue generator and has catalyzed growth in other sectors. However, as competition in the wealth management market stiffens, investors are closely watching whether Morgan Stanley can further broaden its asset management capabilities.

Additionally, Morgan Stanley's wealth management division has encountered heightened regulatory scrutiny. The primary concerns for regulators revolve around whether Morgan Stanley adequately investigated the identities of prospective clients and the sources of their wealth, as well as the bank's monitoring of clients' financial activities. Some of these investigations have been concentrated on the bank's international clients.

This report follows on the heels of rival Goldman Sachs' first-quarter 2024 results, which also exceeded expectations with a 28% increase in profit, driven by a leap in trading and investment banking revenue. Moreover, the investment banking businesses of JPMorgan Chase and Citigroup have also shown improvement.