Goldman Sachs reported first-quarter 2024 results on Monday, April 15, that surpassed expectations, with a profit increase of 28 percent. This surge was propelled by a significant rise in trading and investment banking revenue. Following the release of these results, Goldman Sachs' stock opened up more than 5% on Monday.

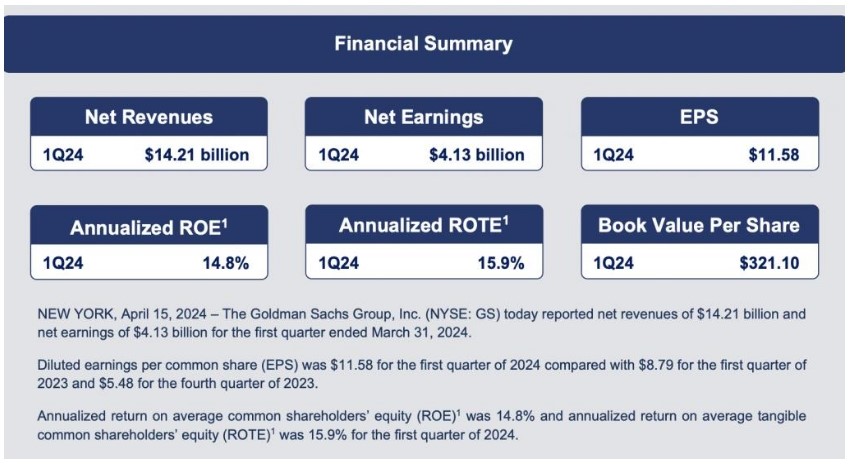

The earnings report indicated that Goldman Sachs' Q1 revenue was $14.21 billion, a 16% increase year-on-year, surpassing market expectations of $12.94 billion. The Q1 net profit was $4.13 billion, up 28% year-on-year, or $11.58 per share, which exceeded analysts' estimates of $8.73 per share. This figure represents the highest level of earnings per share since the third quarter of 2021.

Goldman Sachs' traditional stronghold, the investment banking business, saw Q1 revenue of $2.08 billion, up 32% from the same period last year. This increase exceeded market expectations by about $300 million and was primarily driven by growth in bond and equity underwriting, as well as higher fees from mergers and acquisitions consulting.

According to Dealogic, global mergers and acquisitions (M&A) deal volume rose by 30 percent to approximately $755.1 billion in the first quarter of this year, compared to the same period a year earlier.

Goldman Sachs' Fixed Income, Currencies, and Commodities (FICC) trading revenues for Q1 grew by 10% to $4.32 billion. This growth was fueled by robust performance in mortgage, foreign exchange, and credit trading, as well as finance.

The bank's Q1 equity trading revenue also grew by 10% to $3.31 billion, surpassing expectations by about $300 million, with derivatives trading activity being a key driver.

Unlike its more diversified competitors, Goldman Sachs predominantly derives its revenue from its Wall Street operations. This focus has led to significant returns during market booms and relative underperformance during downturns.

Post its exit from retail banking, Goldman Sachs has pivoted its growth strategy towards its asset and wealth management division. However, this was the sole business segment that did not exceed expectations in Q1. Asset and management revenue increased by 18% to $3.79 billion, which was largely in line with expectations.

The smallest division of Goldman Sachs, Platform Solutions, experienced a 24% growth to $698 million, beating market expectations by about $120 million. This growth was driven by higher credit card and deposit balances.

Goldman Sachs' Q1 provision for credit losses increased to $318 million, up from $171 million a year ago, related to its credit card and wholesale loan portfolios.